Answers

Feb 11, 2019 - 08:28 AM

Here is a great resource to help determine where you have “nexus”, and an obligation to collect and remit sales tax in the US -

https://www.avalara.com/us/en/learn/nexus/find_your_nexus.html

Every state has different rules and thresholds.

If you trigger nexus in a state, either by having a physical or economic presence, you need to register to do business in that state. Avalara can help with that too

(https://www.avalara.com/us/en/products/small-business/business-license-and-regi

stration.html).

Feb 11, 2019 - 09:48 PM

Ecommerce tax is the sales tax that is associated with an online transaction (sale). Sales tax is a small percentage charged on that sale by an ecommerce retailer.

Since sales tax is a “consumption tax,” consumers only pay sales tax on the taxable items that they buy at retail.

Since you are already wondering how to go about this, I will emphasize that monitoring tax laws can be challenging for small business owners.

It does not help that state legislation regarding ecommerce taxes keep changing frequently which makes it difficult to stay on top of the law.

Where do I have to charge sales tax?

The Small Business Administration (SBA) states that, as a small business owner, one is required to assess sales tax, collect it and pass it on to the stipulated authorities.

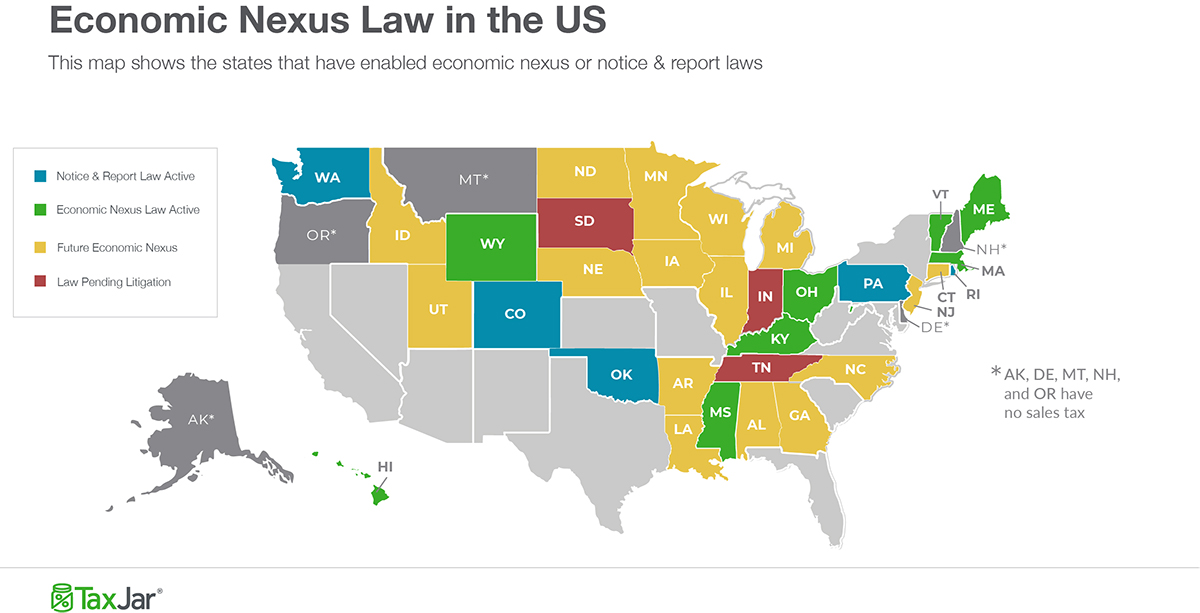

A while ago, the concept of sales tax seemed to be simple for small business owners. However, with the advent of South Dakota v Wayfair Inc. case, matters went on a downward spiral for ecommerce owners.

The decision made it possible for states to charge sales tax on the goods they sell out-of-state.

This implied that one needed not be physically present in a state to pay sales tax, which by far had a huge toll on ecommerce players.

In South Dakota, for example, the state charges sales tax to any business in any state that delivers goods or services worth more than 100,000 to this state, or makes a total of 200 transactions or more annually.

Some Transactions are Exempt from Sales Tax

Different ndividual state governments play by different tax rules and you should check with your government as to which goods can be taxed.

These rules vary a lot but as a general rule, you are not require to collect taxes on the following transactions:

- Raw Materials – if your business produces and sells goods to be used as a raw material for other goods, they are typically considered exempt from sales tax.

- Resold items: resellers are generally not required to pay sales tax on wholesale purchases as the end consumer is assumed to shield the tax burden for those items at the point of purchase.

- Non-Profits – sales to non-profits are generally exempt from sales tax.

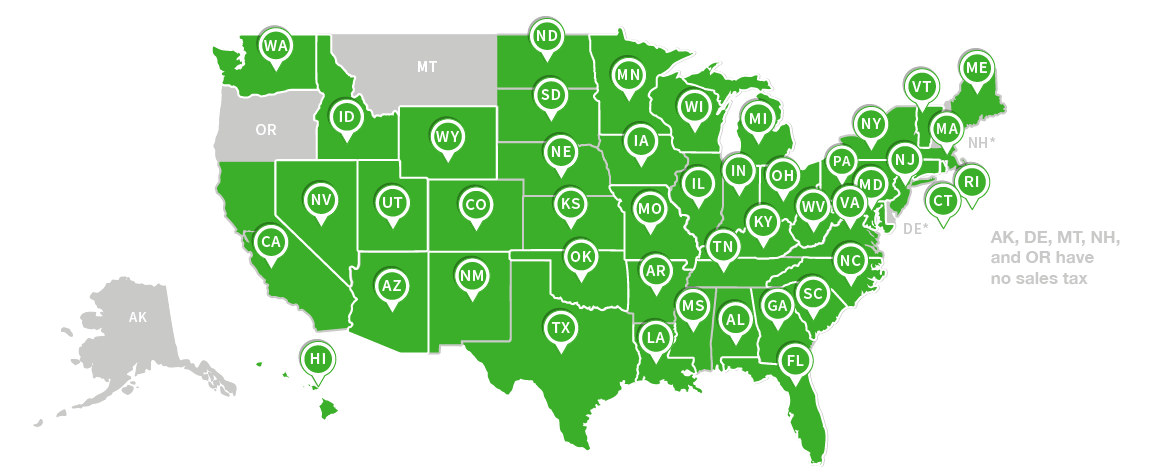

States with Sales Tax

45 states in the U.S. charge state sales tax.

As a retailer, it is your responsibility to collect sales tax in the state. You are responsible for charging your buyers the correct amount of stipulated sales tax, and remit them back to the state.

As far as the responsibility for collection of tax goes, here is how to go about your sales tax:

The cardinal rule for internet sales tax collection is that:

- Your business as well as customer should have a sales tax nexus in the same state.

- The product, for which you intend to collect tax, should be taxable in that state.

If you have a nexus in a state, then it means that you have a significant connection to a state, and thus you have a cardinal responsibility to charge sales tax to buyers in the state.

One thing that is constant with sales tax nexus is that you will always have a sales tax nexus in your home state.

However, there are different ways in which your business or it activities may create a sales tax nexus in other states. You will have a sales tax nexus in other states by virtue of:

- Location: if you have an office, warehouse, or any physical presence of your business in another state

- Personnel: if your business has an employee, sale representative, contractor, or agent in another state, then you have a sales tax nexus in that state.

- Affiliates: if you have someone who advertises your products in another state in exchange for a cut of the profits creates a sales tax nexus in that state.

- Inventory: storing inventory in another state is considered to cause nexus in most states, regardless of whether you have another place of business or personnel.

- Drop shipping: a drop shipping relationship creates a nexus in many states as well. This nexus occurs if you have a third party to ship items to your buyers.

There are many scenarios and conditions that creates sales nexus in other states. Have a look.

What is an easy way to deal with this?

I hope you are getting professional help to file your own business taxes, but just in case you do them on your own, you need a good tax software application, or program.

Fortunately, there are apps that can help you get around the hustle of sorting your taxes. Here are a few apps that can make your job lighter: TaxJar, Avalara, TurboTax

Always ensure that you are partnering with a reliable and great company as inaccuracies and incompleteness of forms are unforgivable. Hence, you need to find software that gets it right the first time.

Add New Comment