Part 1: Blue Ocean Strategy "“ Finding and Exploiting Uncontested Markets

Overview - What is Blue Ocean Strategy?

Blue Ocean Strategy has been a corporate and business “buzzword” for over twelve years. But it is part of the business strategy lexicon for a reason. Blue Ocean Strategy is a powerful tool for entrepreneurs who want to create new markets instead of competing within established markets.

The goal of Blue Ocean Strategy is not to generate business concepts that compete for market share, but to instead create entirely new markets, making competition irrelevant.

Note: If you plan to start a business that already has an established business model (i.e. casual family restaurant, dry cleaners, convenience store, bakery, auto mechanic shop…), you do not need to use Blue ocean strategy. But it may be worthwhile to examine this material further if you want to put a new twist on an old business idea.

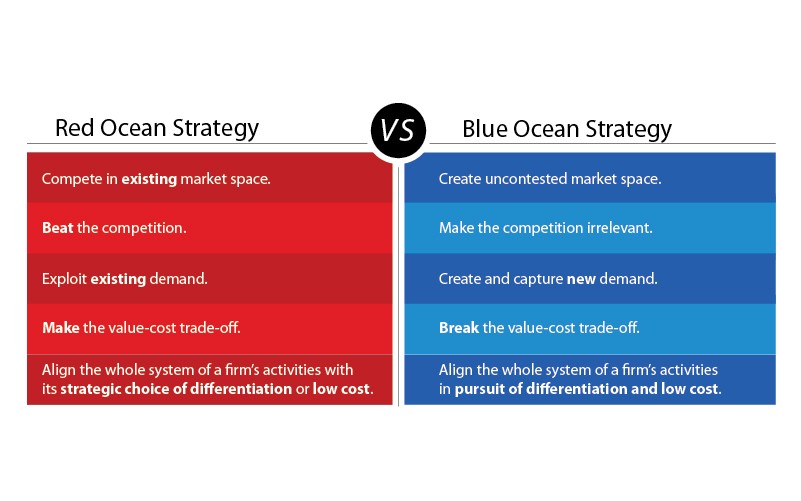

Blue Ocean Strategy was developed by W. Chan Kim and Renée Mauborgne [1] In their seminal business strategy book, the authors divide the marketplace into “Blue Oceans” and “Red Oceans.” Red Oceans are all the industries in existence today that serve the known market space. In Red Oceans, industry boundaries are defined, accepted, and the competitive rules of the game are known.

In Red Oceans, companies try to outperform their rivals to grab a greater share of product or service demand. As the market space gets crowded, prospects for profits and growth are reduced. Products and services then become either commodities or niche and cutthroat competition turns the ocean bloody – the Red Ocean. Red Ocean strategy is the conventional approach to business – beating competition in a contested marketplace.

Blue oceans, in contrast, denote all the industries not in existence today – the unknown market space, untainted by competition. In Blue oceans, demand is created rather than fought over. Competition is irrelevant because the rules of the game are waiting to be set. Blue ocean is an analogy to describe the wider, deeper potential of market space that is not yet explored.

The chart above nicely lays out the basic differences between a Red Ocean Strategy and a Blue Ocean Strategy.

Why Blue Oceans are the Way to Go

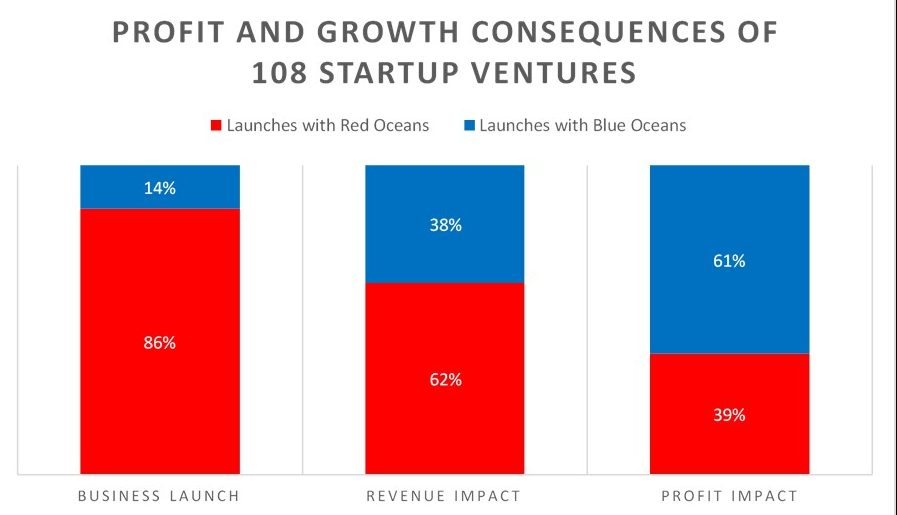

Kim and Mauborgne analyzed quantified the startup launches of 108 diverse companies and found three startling discoveries:

- They found that 86% of the business launches were essentially line extensions – incremental, evolutionary improvements on already existing products or services. Kim and Mauborgne would categorize these businesses launches as Red Ocean startups. Blue ocean startup ventures – those companies who found or created their own uncontested markets – accounted for 14% of the business launches.

- Within those 108 business launches, Kim and Mauborgne also measured the amount revenue generated by these companies. The Red Ocean business launches generated 62% of the total revenue impact of these companies while the Blue ocean business launches generated 38% of the revenue impact.

- Finally, within those 108 business launches, Kim and Mauborgne discovered that the Red Ocean business launches accounted for 39% of the total profit impact while the Blue ocean business launches accounted for 61% of the total profit impact.

Bottom line: Blue ocean startups were 14% of the business launches but accounted for 61% of the profits. As Joe Biden would say, “that’s a BFD”.

Value Innovation – the Secret Sauce of Blue Ocean Strategy

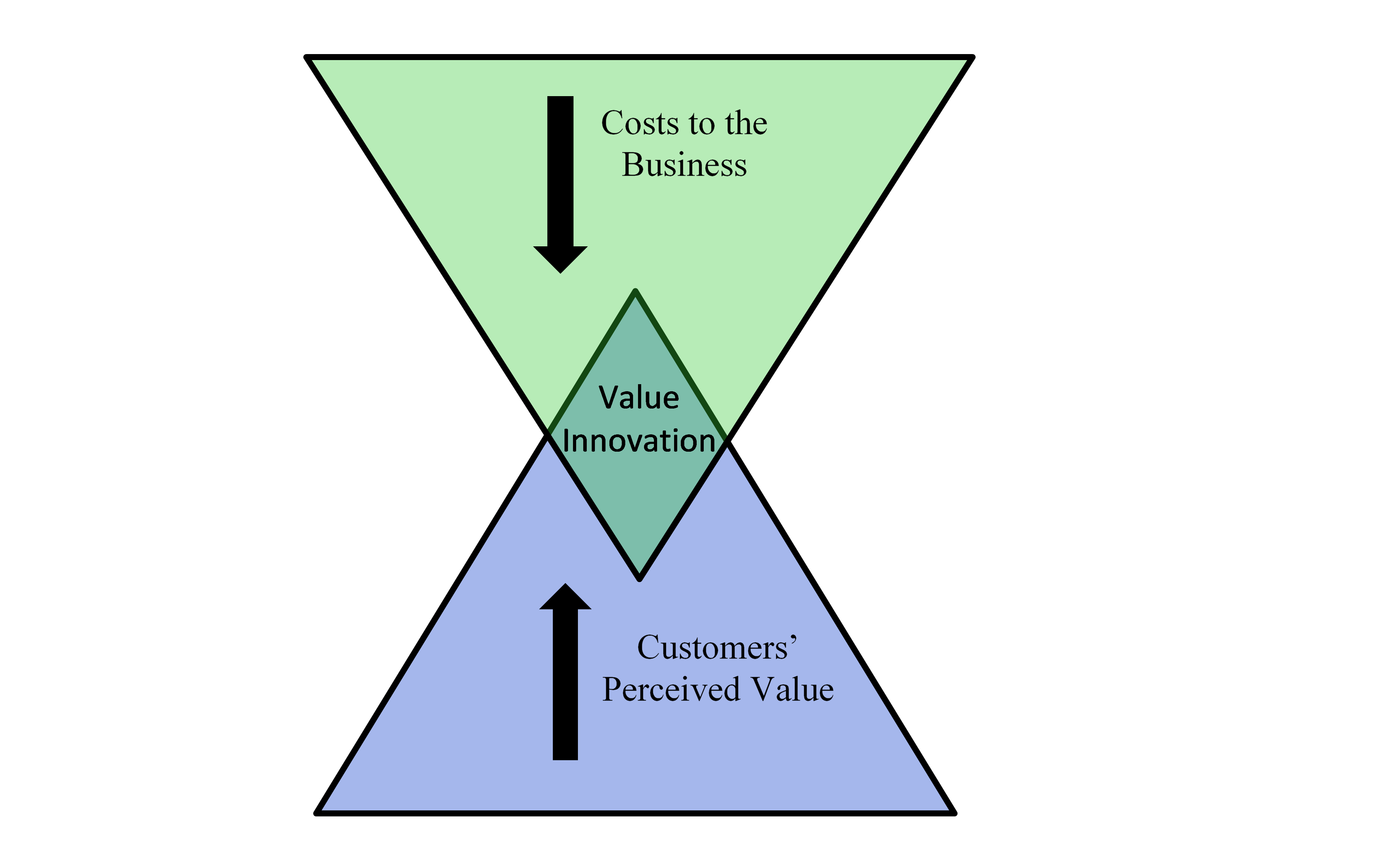

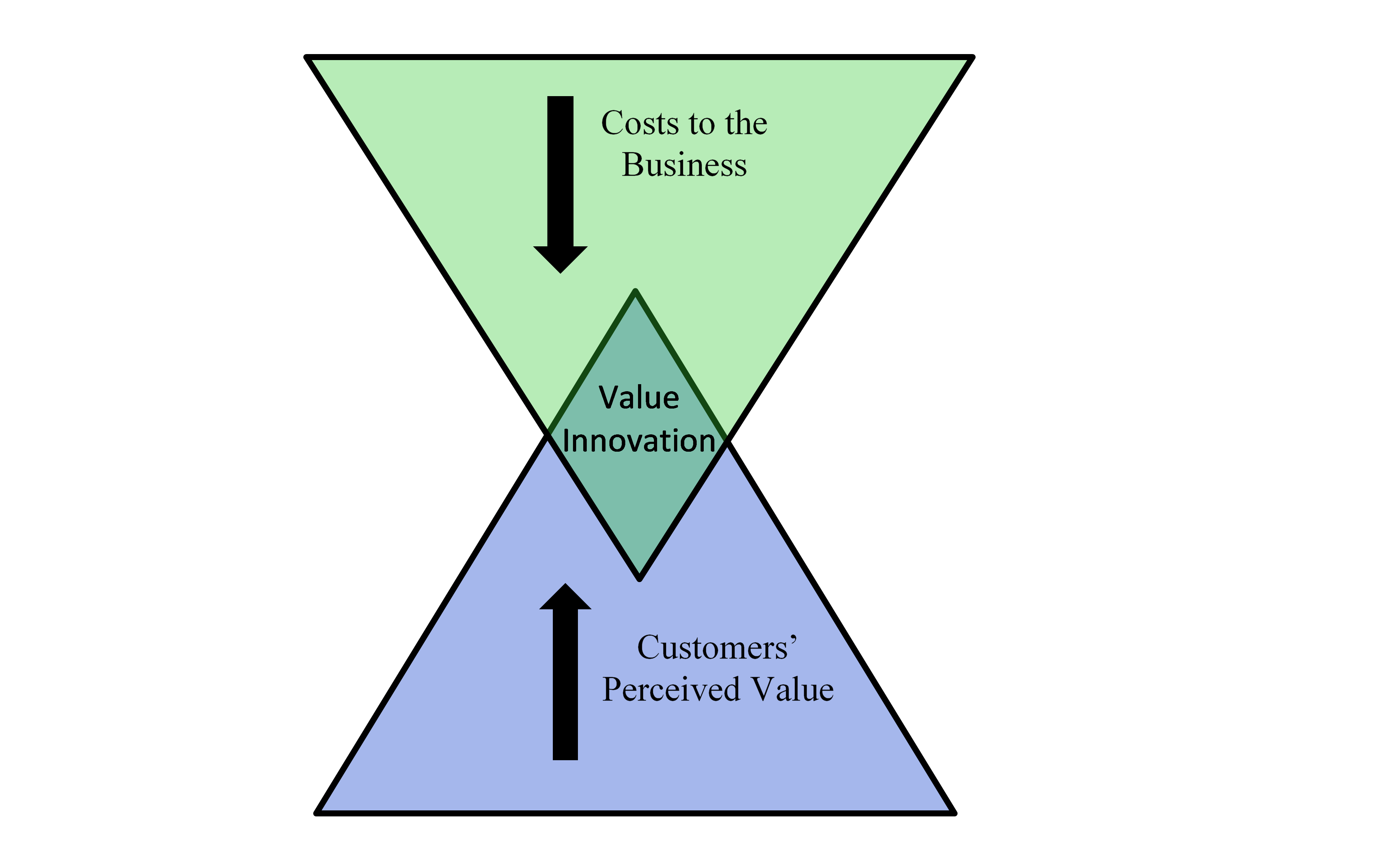

The cornerstone of Blue Ocean Strategy is creating value innovation – creating a leap in value for both the business and its customers, thereby opening up new and uncontested market space. The main idea that powers Blue Ocean Strategy is to create new markets – which are thereby devoid of competition - instead of competing in existing markets populated with dangerous competitors.

Some definitions are needed to unpack the two sentences above.

Value innovation is the combination of two distinctly different concepts – value and innovation. Sounds simple right? Well, first impressions can be deceiving. We must first define markets, value propositions, value and innovation, then define the components that comprise each.

- A market is defined as an aggregate group of people with the desire and ability to buy a specific bundle of goods and/or services (value proposition). For example, the total consumer demand for compact cars in the United States constitutes a market. A market for a value proposition can be further divided into market segments.

- A market segment is a group of people who have similar geographic, demographic, psychographic or behavioristic characteristics that are willing and able to buy a value proposition. For example, the market segment for hybrid cars is an example of a market segment. Groups of hybrid car owners can be broken down into certain geographic, demographic, psychographic and behavioristic clusters.

- Value: When a business delivers a value proposition to a customer, the exchange creates value for both the customer and the company. Therefore, the value of the exchange can be measured either from the perspective of the business or the customer.

- Value, from the consumers’ perspective, is the worth customers place upon a business’s value propositions. If – from the customers’ perspective – a business increases the value of its offerings, then the company can extract more revenue from its value propositions through increased sales or prices.

- Value, from the business’s perspective, is the economic gain the business derives from selling its value propositions. This is the net profit (revenue – costs) gained from sales of a value proposition.

- A value proposition is a bundle of products and/or services that caters to the requirements of a specific customer market segment.[2]

- Innovation is a technology advancement or process improvement that may lead to an increase in customers’ perceived value for a business’ value proposition.

The definitions above are dense concepts. They are not easy to wrap your head around and it may take several (or in my case, dozens) of passes to digest them properly. But, after defining these crucial concepts, we now have the building blocks to define value innovation.

Value innovation occurs when companies create value propositions that “align innovation with utility, price, and cost positions.” [3] This is accomplished by both increasing the value proposition’s value to a customer market segment(s) and increasing the absolute economic value of the business’s value propositions to the business.

Kim and Mauborgne coined this concept “value innovation” because “instead of focusing on beating the competition, you focus on making the competition irrelevant by creating a leap in value for buyers and your company, thereby opening up new and uncontested market space.”[4]

Diagram: Value Innovation

Trust me, Value Innovation is pretty hard for an established business to successfully pull off because true innovation is typically hard. Period. Plus, Value Innovation is probably a threat to a successful business’s already established business model. Therefore, most established businesses opt for the following approaches to increasing their customers’ perceived value of their products and services:

Increase customers’ perceived value with minimal costs to the business.

A business can increase the value of its offerings without innovation. The business can do this by creating an incremental increase in the customers’ perceived value of its products and services (its value propositions), but not measurably improve, from the business’s perspective, the economic value of its value proposition(s).

Increasing value without innovation is usually done to maintain a company’s market share in a Red Ocean Market. In effect, it’s the business version of keeping up with the Jones’s. An example of this would be a car company making slight stylistic and/or functional changes in one of its car lines from the 2017 model to the 2018 model.

This is a business version of sleight of hand. Customers may fall for this or be satisfied by it in the short run, but in the long run they will tire of it and seek out other market alternatives.

Increase customers’ perceived value with significant costs to the business.

A business can increase the customers’ perceived value of its value proposition(s), without innovation, only through making a conscious choice to lower prices or increase the quality of its offerings. Either decision usually leads to undesirable cost-value trade-offs. So, if a business increases the customer’s perceived value in a business’s value proposition(s) by lowering prices or adding features, it will not increase the economic value the company derives from its value proposition.

A lower price may sell more of a product, but this will reduce the economic value the business gains from each sale. Also, a business can increase sales of one of its products by adding features that increase customers’ perceived value of it. But adding features, without innovating, will reduce the costs to the business for each product produced, thus lowering the economic value the business derives from each product sold.

Innovation without Value Innovation without value is possible too.

In fact, it happens all the time and under the radar. Innovation without value “tends to be a technology driven, market pioneering, or futuristic, often shooting beyond what buyers are ready to accept and pay for.”[5]

For example, an inventor can create a product that no market segment really understands or wants. If you want to see examples of this, just peruse the US Patent and Trademark Office website for a while. Its filled with interesting, novel innovations that markets ultimately didn’t want.

Click Here For Part 2

[1] W. Chan Kim and Renée Mauborgne, Blue ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant, Harvard Business School Press, Chapter 4, 2005.

[2] Alexander Osterwalder & Yves Pigneur, Business Model Generation, John Wiley & Sons Inc., pg. 22, 2010.

[3] W. Chan Kim and Renée Mauborgne, Blue ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant, Harvard Business School Press, pg. 13, 2005.

[4] W. Chan Kim and Renée Mauborgne, Blue ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant, Harvard Business School Press, pg. 12, 2005.

[5] W. Chan Kim and Renée Mauborgne, Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant, Harvard Business School Press, pg. 13, 2005.