Answers

Aug 03, 2019 - 12:31 PM

Arguably, lots of the biggest brands around today were once “crazy startup ideas.” Once something’s successful, it no longer seems quite so crazy. Here are just a few of those wild ideas that panned out well.

Yeti Coolers

Yeti Coolers is a classic example of a startup that exploited an untapped niche. Today, the luxury cooler brand seems to make sense, but when Yeti was founded, few people could imagine paying $300 or more for a cooler.

The founders discovered that few small outdoors shops carried coolers, since the stores couldn’t usually profit much from these low-priced items that took up lots of room. They also realized that outdoorsy people would benefit from having rugged, reliable coolers that wouldn’t get thrown out after a few uses. By tapping into this untapped niche of the outdoor market, the crazy idea worked well. (Read more details about Yeti’s success on this thread.)

Image via Pixabay

Twitter

The idea of instantly sending your current status or thoughts to hundreds (or thousands) of people doesn’t seem so crazy now. But when Twitter was first posed to investors, many of them weren’t interested.

It seemed boring, or even creepy, to be able to send a “text” about what you were currently doing to everyone at once. The idea for Twitter was actually a spin-off from a podcasting platform called Odeo. When iTunes podcasting rendered Odeo irrelevant, the small team working for the startup started looking for new ideas to stay relevant. But when the idea for Twitter was pitched, few of them were into it.

Even after hearing about Twitter, Odeo’s investors agreed to a stock buyback that would cost them millions of future dollars. But since Twitter was such a new and crazy idea, they couldn’t see how it was poised to take off.

Starbucks

Who can imagine the U.S. (or the world, really) without Starbucks in it? But just a few decades ago, this was a crazy startup idea too.

When the first Starbucks opened in 1971, Americans drank coffee. Regular coffeepot coffee. Lattes and the like were practically unheard of in North America. And for about 10 years, Starbucks did sell ordinary coffee. The “crazy idea” came when then-director of marketing Howard Shultz visited Italy in 1982.

There, he saw people buying fancy espresso drinks in “coffee bars” that also served as gathering places. However, the Starbucks founders didn’t see the value in the idea, so Shultz left the company to start his own Italian-style coffee bar.

In just two years, his startup was successful enough that he was able to buy Starbucks, which is why Shultz is now widely thought of as the founder of Starbucks. Under Shultz’s direction, the brand boomed through the ‘90s, gradually making the Italian coffeeshop experience ubiquitous in the U.S.

Image via Pixabay

Airbnb

When Airbnb got started, people were still getting used to the idea of using platforms like Craigslist to find roommates. But Airbnb made it even crazier: why not rent out parts of your home to complete strangers on short-term trips, bringing vastly more new people through your home than just a roommate or two?

The founders thought their idea had potential, but early on, they struggled to convince investors. How could an air mattress in a spare room (the inspiration for the Airbnb name) really compete with full-service hotels? It was only after years of struggle that the founders were able to convince investors - and users - that their platform was truly worthwhile.

PayPal

Today, you can choose how to send money online: there’s Venmo, Cash App, Facebook Messenger, and, of course, PayPal. But when PayPal got started, it was the first of its kind. The internet was still new to most users, and the idea of using it to send money didn’t inspire confidence in many people.

PayPal launched in 1999, and became successful surprisingly fast. By offering convenience and avoiding scandals, the company helped people warm up to the idea of sending money online. But when it started, even online banking was still fairly new, and there was no guarantee that sending money online would catch on as fast as it did.

Image via Pixabay

Snapchat

Even now that social media use is common, new social media sites often sound crazy until they take off.

Snapchat, for example, offered a crazily innovative idea: a social media platform that hinged on temporary posts. Rather than building a semi-static “profile,” users would share content designed to disappear. The founders successfully predicted a new trend in social media use: posts that showed “real life,” in real-time, rather than a curated version of life.

The platform appealed to the social-media-savvy Gen Z crowd in particular. The young people who grew up with social media felt comfortable documenting their lives in this ultra-personal, fleeting way. Today, Snapchat offers more than just disappearing pictures. But it was this crazy-sounding feature that first helped set the platform apart so it could rise to success.

These stories go to show how hard it is to predict startup success. Some of today’s biggest companies started out as crazy ideas. Yet there are countless more startups whose crazy ideas never led to success.

One thing that set most of these successful founders apart: they built startups based on their own needs and wants, rightly predicting that other people would have the same needs and wants. Build something you’d like to use, and other people just might want to use it, too.

Aug 13, 2019 - 04:58 PM

The previous answer is correct in pointing out that many of today's mainstream companies were thought of as 'crazy ideas' initially. I especially like the Starbucks example because of this story told by one of the OVP partners (an investment firm) that laughed Howard Schulz out of their office when he pitched the idea for starbucks:

“A guy walks into your office… and says he wants to open a chain of retail shops selling a commodity product you can get anywhere for 25 cents, but he will charge 2 dollars. Of course, you listen politely, and then fall off your chair laughing when he leaves. Howard Schultz didn’t see this as humorous. And we didn’t make 500 times our money.” OVP believed that there was no market for Starbucks’ premium coffee, which may indeed have been the prevailing wisdom at the time,

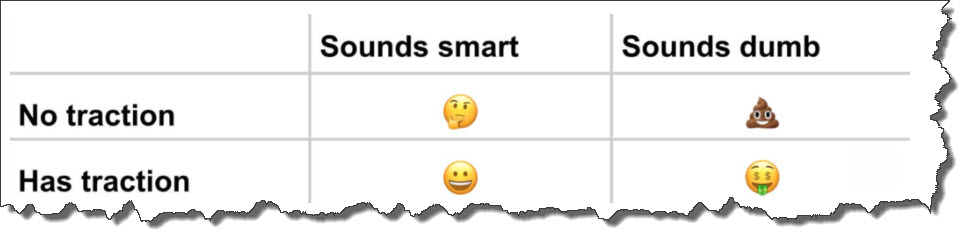

Andrew Chen (a partner at the venture capital firm Andreesen Horowitz) has also pointed out this phenomenon in his 2 x 2 matrix plotting traction versus the smartness/stupidity of an idea. He calls it the "Dumb Idea" paradox:

The Dumb Idea Paradox – the official definition The dumb idea paradox is what happens when an idea sounds dumb, and yet you have a (usually very small) group of people highly engaged in doing it. And maybe that group of people seem to getting bigger and bigger. Will it continue? Will millions ultimately do this thing? When products that have this property — it’s counterintuitive behavior PLUS it traction — imho they are the most attractive startups in existence. After all, this is an indicator it’s likely in a new market, and often times, the TAM of these markets ends up being huge! In other words, this handy graphic:

A startup with an idea that sounds silly (crazy) and is gaining traction will almost always outperform a startup with similar traction but that is doing something smart. There are a couple reasons why:

- If the idea is 'smart', chances are it is more obvious and more people will be doing it, therefore more competition.

- Silly or crazy ideas get a lot more press. What is there to write about a company doing something smart? It doesn't make for good news stories. Silly ideas naturally lend themselves to press coverage and sharing on social media and benefit from all the free traffic during the crucial early days when funds may be tight. In my interview with Niko Bonatsos, he pointed this out as one of the criteria he uses to decide whether or not to invest in a startup.

Niko explaining how he likes to invest in ideas that sound silly or annoying.

Other ideas that come to mind that are now considered mainstream but were crazy at the time:

- Bloomberg Devices: Michael Bloomberg is worth $55 billion based on the success of his eponymous company Bloomberg LP and their financial data devices that are ubiquitous on Wall Street. Apparently when he told his partners at his former firm Salomon Brothers that their data was just as valuable as their capital and they should monetize it, they wondered what he had been smoking and summarily fired him!

- Selling Software: Funny as it may sound in the early 1970's few people believed that software had value--the prevailing thinking and behavior among users was that you paid for the hardware, and copied/shared the software freely! Bill Gates wrote this famous 'open letter to computer hobbyists' lecturing them on the topic and decrying the rampant theft of his company's software product.

- Bottled Water: A multi-billion dollar industry. Who would have thunk? After all, in the developed world anyone can turn on the faucet and get a free cup of water that is safe to drink. The two top selling brands (Aquafina and Dasani) are owned by PepsciCo and Coca-cola respectively. A story I've heard about Coke's entry into the bottled water market is: Under the leadership of former CEO Robert Goizueta, Coke decided that obsessing over and competing with Pepsi was small fry. Instead, they would compete with the situation i.e. when anyone, anywhere at anytime desires a beverage, Coke should have something for them. They therefore diversified into orange juice, bottled coffee, bottled tea and of course bottled water. The strategy worked and Coke's market value multiplied by 34x, from $4.3 billion to $150 billion during Goizueta's tenure--making him the second person in history to become a billionaire through company stock in a company where he was neither a founder nor family member (Steve Ballmer at Microsoft was the first). Fiji Water also turned Stewart and Linda Resnick into billionaires.

Add New Comment