Answers

Nov 07, 2017 - 11:09 AM

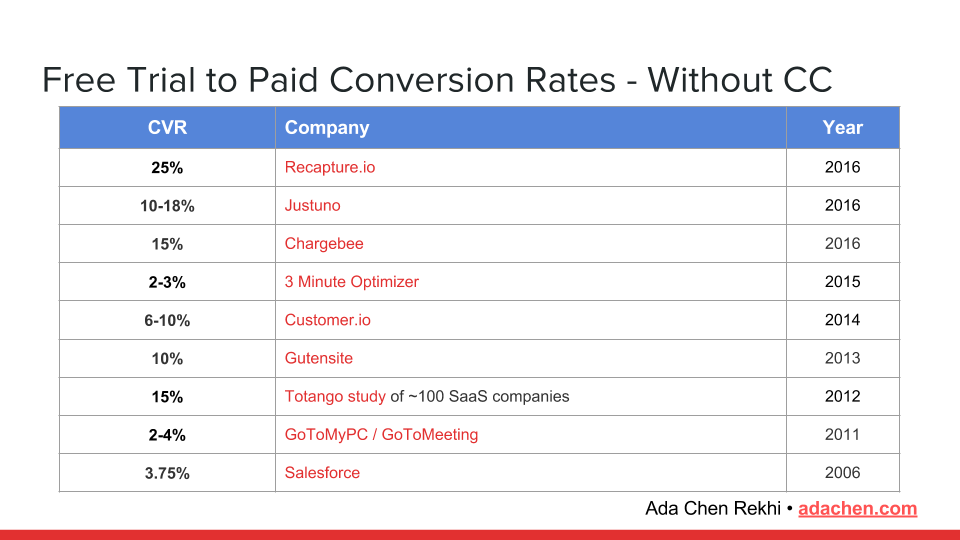

Free to Paid Without Credit Card

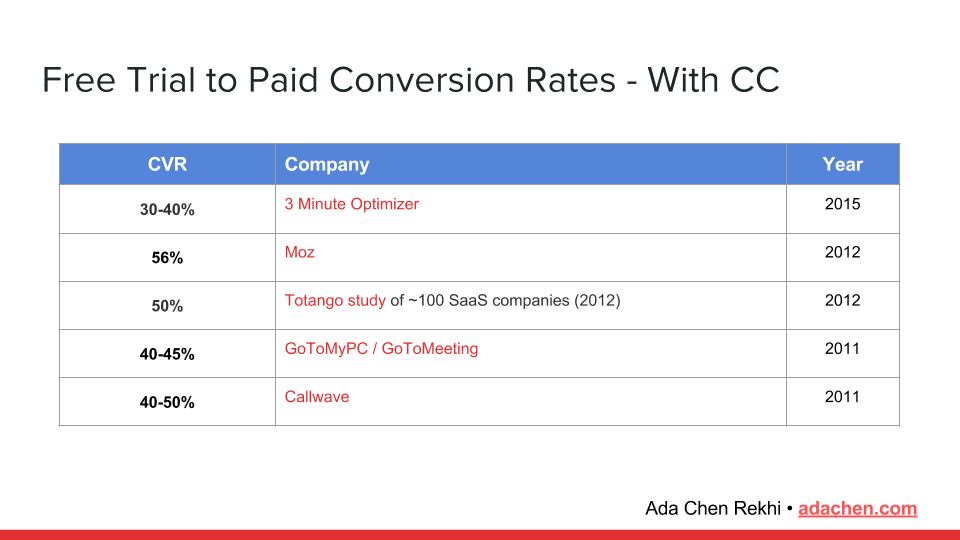

Free to Paid With Credit Card Required

And here is a link to her article.

Nov 18, 2017 - 05:23 PM

5% is reasonable. 10-15% is fantastic, category-leading, etc.Doubly confirm that clearer marketing materials (everything needed to convey your value prop) make a world of difference and I would include on-boarding alongside the typical marketing collateral (landing pages, white papers, webinars, etc.).

The whole debate on whether you should or shouldn’t ask for credit card at signup is not relevant these days. SaaS is commodity now. Do whatever you need to do to show value quickly and with the least amount of effort from the prospective customer.

Nov 18, 2017 - 05:26 PM

I have to disagree with your comment about SaaS is mainstream means that credit card at signup is not relevant - certainly for B2B, but to some extent for consumer.

Credit card signups for services tend to be negative options – the person who signs up has to commit and then explicitly cancel. That adds friction to starting a trial In a business setting, the person who wants to experiment has to have signature authority or be able to justify to a manager. I can imagine some situations where the commitment is needed, but why add the friction if you don’t have to?

For a one-off purchase, or perhaps a service that is low enough cost that the price appears more aligned with a piece of inexpensive software, I’d expect a money back guarantee – sometimes with a free version available too. I just tried to use a free version of a tool, and then found that what I needed wasn’t available in the free version. They offered a demo version of the paid product (one-off pricing), but the demo did not give me any confidence that the paid version would work. I contacted the tech support at the vendor and was told that my impression was correct, so I didn’t buy.

I have purchased quite a few tools that needed more extensive evaluation, so a money back guarantee works. I’ve probably used money back for fewer than 10%, because I’ve researched first.

Why not take the same approach with SaaS services? Don’t use the negative option, offer money-back (the entire amount, not just unused months) and be prepared for lower signup if the service can’t be tested without a commitment that involves paying. OTOH, the smaller number of customers who do pay to try are more secure and cover the cost of servicing them. It’s situational – based on the service and the purchasing process - not related to SaaS being accepted.

By the way, if you are interested in learning more about pricing for SaaS check out our work on PricingGurus.

Nov 18, 2017 - 05:31 PM

Even if they weren't useless, the time it takes to move our mailing list, get everything set up, and, of course, prepare and send out a newsletter far outweighs any savings from not paying for a month.

We have to do the research first so we don't have to switch twice. The number one thing I want is better, clearer, and more accurate marketing materials. In other matters ... you will turn people off by requiring a credit card for a free trial.

Either it's a free trial or it's not. This will matter less for businesses, but, if you think the free trial will get people to buy, every hoop you make them jump through beforehand is a reason for them to leave.

On Stefan's numbers, I can't comment on B2B, but in consumer products, 1% is reasonable, there are companies pretty happy with 2%, 5% is very good. 10-15% is unheard of. But, whatever your conversion %, it doesn't matter unless you bring enough people to the top of the funnel.

As for Ada Chen's "research" above, here my takeaway summary:

Freemium: 1-30% conversion (5-10 data points)

Free Trial without credit card to Paid: 2-25% conversion (9 data points)

Free Trial with credit card to Paid: 30-50% conversion (5 data points)

Aha! It must mean that you increase conversions if you ask for a credit card.

Unfortunately, I do not think that is correct. Look, for example at GoToMyPC/GoToMeeting — 2-4% without a credit card and 40-45% with a credit card. What does that really mean? Without having actual data from the company, there are a variety of conclusions that could be reached:

* People who put in a credit card are more likely to convert to paid

* People who put in a credit card are more likely to forget to cancel

* People who have already decided to pay put in a credit card and >50% of them cancel anyway (oops); very few of the remaining people convert

* Business users who are more likely to pay are also more likely to put in a credit card at the beginning (not a surprising conclusion)

In short, this isn't much "research". It's a bunch of data points with no true analysis that doesn't allow you to reach any general conclusions.

Personally, I think the highest conversion rates Slack 30%, Recapture.io 25%, and Moz 56% point to something else — clear marketing messages and a clear value proposition, and this is key no matter what your funnel looks like.

I'm not saying that asking for a credit card doesn't increase conversions. I don't know. I'm just saying this limited data doesn't show it.

Nov 18, 2017 - 05:34 PM

Using Year in the tables gives the impression that the results are contemporaneous, but perhaps the companies changed the model at the same time that they changed the service. Or changed the marketing at the same time they switched the model.

I think some meaningful primary research could be done among people who considered alternatives and either did or didn’t purchase something. Was the requirement for a credit card a deterrent (perhaps causing someone to explore open source or develop something internally) or a positive by suggesting higher credibility of the vendor.

It would have to include the importance of the particular type of tool to the person/organization considering, as well as normalizing for some of the effects discussed in the comments to the post, and ideally the companies being considered would overlap so that you controlled for marketing effects plus get a decent sized sample.

It would be easier to judge causation if correlation is discovered in this hypothetical primary study, than it is for the data points from the companies even if you were able to find out more about the methodology. Almost back to the old advertising adage – 50% works, we just don’t know which 50%.

Still, it’s good food for thought.

Feb 21, 2018 - 09:31 PM

Below is the relevant excerpt. He contrasts "Low-touch SaaS" with "High-touch SaaS". The latter requires salespeople, the former does not.

Low-touch SaaS benchmarks Conversion rate:

Most low-touch SaaS uses a free trial, with the signup either requiring minimal information or a credit card that will be billed if the user doesn’t cancel the trial. This decision dominates the character of the free trial: users who sign in to a relatively low-friction trial may not be very serious about evaluating the software and need to affirmatively decide to purchase the software later, while users who provide a credit card number generally have done more up-front research and are, essentially, committing to pay unless they affirmatively declare they are dissatisfied with the product.

This results in cosmically different conversion rates:

Conversion rates of low-touch SaaS trials with credit card not required:

- substantially below 1%: generally evidence of poor product-market fit

- ~1%: roughly the baseline for competent execution

- 2%+: extremely good

- substantially below 40%: generally evidence of poor product-market fit

- 40%: roughly the baseline for competent execution

- 60%: doing well!

Mar 03, 2018 - 01:35 PM

"Two separate issues here:Don't continue after the trial period ends. This is a successful transaction by the standards of everyone involved, right? The SaaS company successfully induced a user to try it. The user got free use of a product and decided against adopting it.

The various parties that come under the heading "credit card companies" were all instrumental in facilitating commerce. The fact that no funds were actually captured is not maximally relevant to anyone here; no harm happened. This is like a user walking into Best Buy and walking out without buying anything; Best Buy is eagerly supportive of that, within reason.

Buyer's remorse is a real thing, but it is not the case that SaaS companies operating aboveboard have 60~70% of users regret their (actually charged) purchases.

Suppose that a particular customer is dissatisfied with a particular SaaS company. The first line of defense is very clear messaging around trial timelines, payment terms, etc; the company should avoid surprising anyone.

The second is likely the SaaS company fielding a CS inquiry from the customer. The overwhelming policy of SaaS companies in response to "I started a free trial and gave you my credit card to do so, and whoops seemed to have gone over by 2 weeks, but didn't actually use the software." would be some variant of a refund and (if they're smart) an offer to extend the trial.

The reason that SaaS companies have their finger on the refund button is that, in the event of them saying "Well, you agreed to these trial terms, and under our terms you do owe us the $29", the customer can open a dispute with the bank which issued their credit card.

The bank has wide discretion on whether it wants to side with the person who is their customer (and generates revenue for them) or the SaaS company which is not their customer and doesn't generate revenue for them.

Most people who have run SaaS companies will tell you that disputes are unfun and that, even if one is in the right, one will not successfully win a huge percentage of them, and so one should comport one's affairs to generate as few of them as possible.

Note that any company which sustains a dispute rate of above 1% or so will get a very unfun series of decisions made about their business, by either the credit card brands or their credit card processor. You urgently do not want this to happen to your business.

SaaS businesses are not at a very high risk of this happening, particularly when well-operated. They generally sell a product which mostly works to customers who are relatively savvy, and as they have ongoing relationships with customers, their customers only need to go to the financial system for resolution in extremis.

There exist other businesses which are at substantially higher risk of running afoul of high dispute rates even if they do everything right.

Disclaimer: I work at Stripe and so the above is theoretically professionally relevant to me, but I'm speaking here mostly in my personal capacity, as someone who spent 10 years selling software over the Internet on no-card-required and card-required free trials."

Add New Comment