Answers

Oct 24, 2017 - 06:53 AM

Raising capital for a business has evolved over time to current state of (refined process that can be learned)

Think back to companies that were able to raise millions of capital in the 90s, a good percentage of those companies were merely in the idea stage with no actual product or services. Yet they got funded because investors were afraid of missing on exits and perceived returns on their investments.

Start:

Fund raising for any business startup is challenging, it is time consuming and requires expertise including having the right network and speaking the VC language. It has evolved over the years into a process that can be learned and mastered by entrepreneurs and business leaders. To become an expert in startup fund raising, it is important to understand what motivates each side of the transaction –

VCs, angels and friends and family while acting in the capacity of investors, are interested in maximizing the return on their investments with as little risk as possible, while entrepreneurs want to leverage the funds to prototype the idea, scale the company, stabilize the startup and create solution for their customers.

This places the burden on the entrepreneur to be clear and have concrete plans on how and when to return their investors capital with expected gains. The need for investors’ capital gains can sometimes lead to conflicts between investors and entrepreneurs.Investors want to protect their capital from unnecessary risks by entrepreneurs, while entrepreneurs want to continue along the path of scaling the company/project which can sometimes include taking risks that the investors may view or understand to be unnecessary.

In addition to balancing interests of each party, to increase the odds of getting funded. It is better to come to the funding conversation with

So the question for the entrepreneur is – what do you need to successfully raise funding while meeting the above outlined conditions and challenges?

1. Have a Great Idea: Research your idea

2. Become the Subject Matter Expert or Industry Expertise: Do you know more about your industry than your rivals and can you articulate a compelling vision for its future?

3. What is the Market Potential? Is the venture targeting a market that's now small but expected to get big fast?

4. Build a Team: Convince other with the skills you need to work for you for next to nothing

5. Build a Prototype: Create a product or service that you can sell

6. Start Marketing Prototype: Might have to give away the initial version to potential customers

7. Get Feedback from Potential Customers: Integrate customer feedback into final product

8. Go to Market: Create marketing plan and strategies to increase demand for product

9. Show Revenues: Meaning that there is interest in the marketplace for your product)

10. Build a Network of Investors

- Is the entrepreneur a great CEO?)

- Product

- Potential

11. Administrative & Operations

- Register the company

- Secure your domain name

12. Who, How & What to Pitch to Investors

- Team (Do you have a winning team that can execute on the idea?

- Know the VC language and terms

- Know your metrics

- Have defined and actionable strategies

- Clear timeline on deliverables

- Never raise more than 1x your projected earnings even if you are

13.Success (What do you do after you raise the required funds?)

Raising Funding

It can be very challenging to raise capital until you have created a prototype, assembled a team, incorporate the company and start reaching out to customers. The process of raising funding can be started at any time provided items 1-11 in the list above are either in progress or completed.

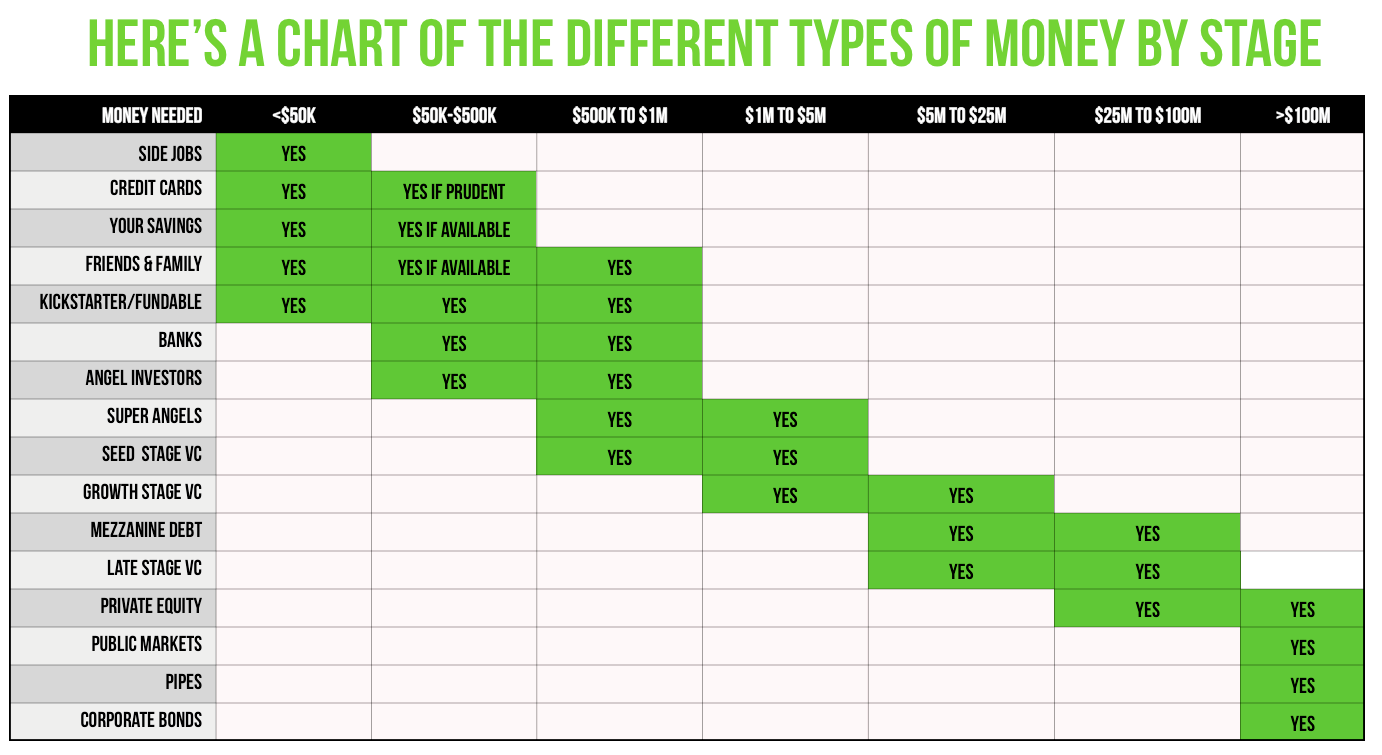

A Chart of the Various Forms of Capital Available At Each Stage of Your Company

Source: The Startup Guide

What Types of Funding Are Available?

Loans

Getting a loan from a bank without security is difficult with an asset to securitize the loan, to provide collateral in case of default. Having revenue makes getting a loan a lot easier. With revenue and profits, banks will lend money. Based on the type of business, generally, banks are comfortable lending between $50K - $500K.Angel Investors

Angel and super angel investors are individuals who will invest between $25K and $500K in exchange for ownership equity. This is level of investment are conducive when a business has a built a product, has paying customers and with a couple of employees who are working for equity. Angel investment can be in the form of equity stake or “convertible note” which can be converted into equity once the company raises additional VC fund in a series A shares offering.Getting to know those super angels and angels is often quite difficult. It takes an investment of time spent networking in the community, talking to other entrepreneurs who have been successful in raising capital and building relationships with them. You can also go to venture capital conferences or other gatherings that bring together investors with entrepreneurs. Incubator programs like TechStars or Y Combinator are another way to connect with angels and super angels. Angellist is one of the best ways to share your pitch directly with high net worth individuals.

Venture Capital

Series A:Once you have a functioning product, (paying & non-paying) customers and users, then you are ready to raise additional significant capital, called Series A. This level of funding can range from $500K up to $2M and could happen in the 2 nd year of the business assuming all milestones and commitments for angel investments are met. The purpose of this capital is to continue to scale your product, team, markets and customer acquisition.

Series B:

Is the growth stage venture capital, and ranges between $5 and $25 million.

Mezzanine Stage:

This is during the growth stage of the company this type of capital is usually not secured by assets, and is lent strictly based on a company's ability to repay the debt from free cash flow. The funds can range from $20 to $25M and is usually in the 5 th or 6 th year with revenues around $25M.

Assuming that the product is in high demand in the marketplace and customers are lining up to adopt and use the product, it is very tempting to ask for all the capital you can get so as not to worry about seeking additional funding in the future. This can backfire. One caution when seeking capital from VC is to avoid raising too much money.

Always raise slightly under (1x) your current annualized revenue.

By using this rule of raising 1x of your current annualized revenue, you’ll be able to maintain control of your company.

How to Negotiate

Raising funding among other competencies also requires having a sophisticate negotiating skills. These include –- Timing of funding requirement

- Previous business success and experience

- Your team and their business and startup experience

- the quality of your advisors;

- Your product and technology

- The size of your market

- Know your competitors

- Alternative costs of investing in your startup vs your competition

- Pipeline of potential investors

- Know your metrics in and out

Negotiating Your Valuation

- CEO’s past exits and results

- Team experience

- Size of the current user base

- Level of competency and number of engineers/developers in the company

- Location of the company

Know what these terms mean:

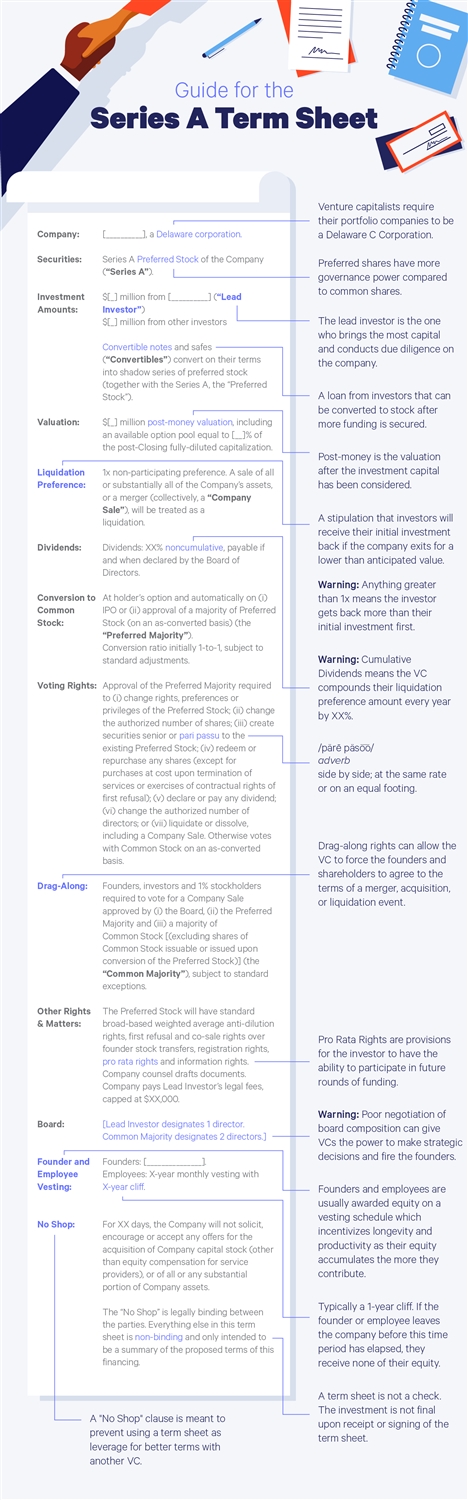

Items in the Term Sheets:

- Valuation

- Option pool size

- Liquidation preferences

- Founder revesting

- Veto rights

- Type of preferred stock

Items Outside of the Term Sheet:

- Portfolio Alignment

- Partner Chemistry

- Partner’s Operational Experience

- Network

- Successful Exits

To Summarize – Raising Capital:

1. Raise your Series A only after you have regular recurring revenue.

2. Raise small angel round until you have proven business model that can yield multiple return on investor’s dollars at exit.

3. Only raise money after you have a strategy on how to use it as well as estimate how long it will take you to reach each milestones before needing additional funding.

4. Remember that equity capital, or venture capital, is the most expensive type of capital you can raise.

May 11, 2020 - 10:23 PM

The first question that you need to answer is whether raising venture capital is truly the right path for your business to take. Not every startup needs venture capital funding in order to enable and sustain rapid growth.

It’s perfectly alright for your company to never raise money and remain a successful, self-sustained small business that can be profitable and meet its goals without having to seek financial help from a VC.

But if you believe that you have a billion-dollar idea and all signs in your growth trajectory show that your ideas are achievable with the help of a VC, then by all means, go for it.

Raising Series A Funding

The first type of funding any business would get is what is called “seed funding.” This could even be loans from friends and family. Seed funding will help you get started so that you will be able to present your idea in a way in which potential investors can see the potential of it.

The first real milestone when it comes to VC funding is Series A. See funding usually means that you’re getting a few thousand here and there, but with a Series A funding round, you’re usually getting millions.

This is because VC firms prefer to invest big in ideas that they truly believe in rather than offer smaller investments to companies that they are not entirely sold on. In other words, they are investing in companies that they believe can earn their money back for them quickly.

As far as when the right time is to try and raise Series A funding, there really is no correct answer and every factor is very much dependent on the company in question and its product or service.

Finding the Right VC

Just as the right time to seek an investment depends on the circumstances and characteristics of your company, so does the actual plan of action when it comes to choosing the right investors.

What’s most important is that the core competencies of the VC that you choose need to align well with your company and industry. However, it’s also important to be very thorough in your research and cautious when seeking funding.

For example, it’s great to have an investor that believes in your industry and has a very strong understanding of it. If this is the case, it’s also important that you're making sure that the VC hasn’t already invested in a startup that you would consider to be a competitor.

Once you’ve picked a few VCs that look to be a good fit, then it's time to try to get their attention and put your company on their radars. Obviously, cold emails aren’t going to cut it.

When it comes to getting your foot in the door, networking is still king. Being able to meet the right people and form the right connections is a very underrated skill that entrepreneurs need to possess, especially if they are looking for funding.

Look through your connections to see if you know anyone who is linked in some way to the VC firm that you are interested in and ask for an introduction. A cold introduction from a real person should definitely work better than a cold email from yourself.

Making the Pitch

When you finally get a chance to pitch your company to VC representatives, the most important thing to remember is that the pitch should be a conversation, not a monologue. If an investor is truly interested in your ideas, then he or she will want to ask questions and get involved in a discussion about your business with you. No one wants to sit and listen to you talk about metrics for an hour.

However, this doesn’t mean that you should just go in and wing it. Make sure that you have a prepared presentation as a starting point and outline for what you want to talk about with your potential investors and what topics you’d like to cover.

Here are some tips for putting together the perfect pitch:

The Term Sheet

You’ve won the investors over with your pitch and they are ready to start funding your company! What’s next? The term sheet!

The term sheet outlines the terms by which the investor will fund your company.

Here’s a good look at what a typical term sheet looks like and what information it should include:

Don’t Forget Insurance

An often overlooked and underrepresented concern when raising capital is directors and officers insurance, which protects against suits brought by investors for a breach in fiduciary responsibility, by employees for failure to comply with workplace laws, and by customers for a lack of corporate governance.

This protects the directors and officers from personal prosecution in matters of the company. If the company files for bankruptcy, for example, the directors and officers of the company won’t be personally responsible for the debts of the business.

Since someone from the VC firm will most likely be joining your board of directors as a result of the funding, they will demand to be protected with a good D&O insurance policy, making it mandatory coverage for any business that wants to seek funding.

Add New Comment