Answer

May 07, 2019 - 11:49 AM

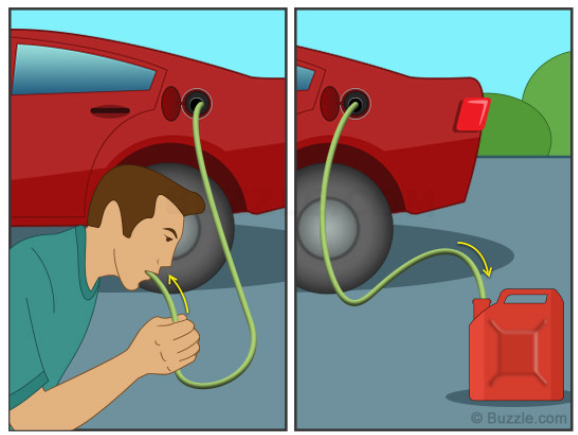

A chargeback is similar to a gas thief siphoning gas out of your car tank! Image credit: WheelZine.com

Most chargebacks are attributed to credit card fraud, but that’s not necessarily the primary reason for chargebacks. Merchant issues, like processing errors, can also be a culprit.

But it sounds like chargeback fraud on your customers’ part is your biggest worry - and it’s not an uncommon issue.

Customers do sometimes commit fraud on accident. However, it’s all too common for them to use the chargeback process as a way to effectively steal from a company. You’ll need to close up the loopholes that they’re exploiting, while also preventing chargebacks from the other two sources. These steps should help.

Update Product Descriptions

Some customers will request a chargeback on the basis that the product’s description didn’t match what they received. Make sure to keep your product descriptions detailed, accurate, and up-to-date to eliminate this loophole. Posting lots of images of your products on your site will help, too.

Provide Great Customer Service

You can also prevent some chargebacks (and get more sales) by boosting your approach to customer service.

For example, if you take recurring payments, make the cancellation process clear and easy for your customers. Post contact information clearly on your website, so customers won’t request a chargeback just because they couldn’t get in touch to resolve an issue. Try to respond to customer inquiries as fast as possible.

Speed up Shipping

If a customer expected to have their product already, but hasn’t received it yet, they might request a chargeback. Having fast shipping, and being clear on shipping times, can help.

Send tracking numbers too, so your customers can see where their purchase is en route. Make sure to communicate clearly if there’s a shipping delay for some reason.

Change Your Name

Your customers know your business name, but do they recognize the name of the transaction on their credit card? These credit card descriptors can trigger chargeback requests when the customer doesn’t recognize where the charge came from.

The best credit card descriptor is the actual name of your business - or whatever it says on your site. You can also send an automatic note to customers to let them know how the charge will appear on their credit card statement.

Have a Clear Refund Policy

You can also reduce chargebacks just by streamlining the refund process. Make it clear when and how customers can get a refund, so they can use that avenue if they’re not satisfied with their purchase (and meet your refund requirements).

Refunds are better than chargebacks, since they protect your rating and reputation better. It’s okay to decline certain refund requests, but you’ll also need to give out some refunds to keep chargebacks to a minimum. Make sure your website clearly states which refund requests will get declined, and why.

Use Opt-In Subscription Models

Finally, if you offer a subscription with a free trial period, make sure your customers have the chance to opt in before they get charged. Otherwise, those surprise charges can result in a lot of chargebacks for your company. Customers also are more likely to stay loyal to a brand that doesn’t hit them with unexpected, sneaky-looking charges.

Add New Comment